It’s that time of year! So, let’s talk about 2023 contribution limits and the recent announcement from the IRS to increase the annual limit.

There were some pretty significant changes announced, so here is what you need to know:

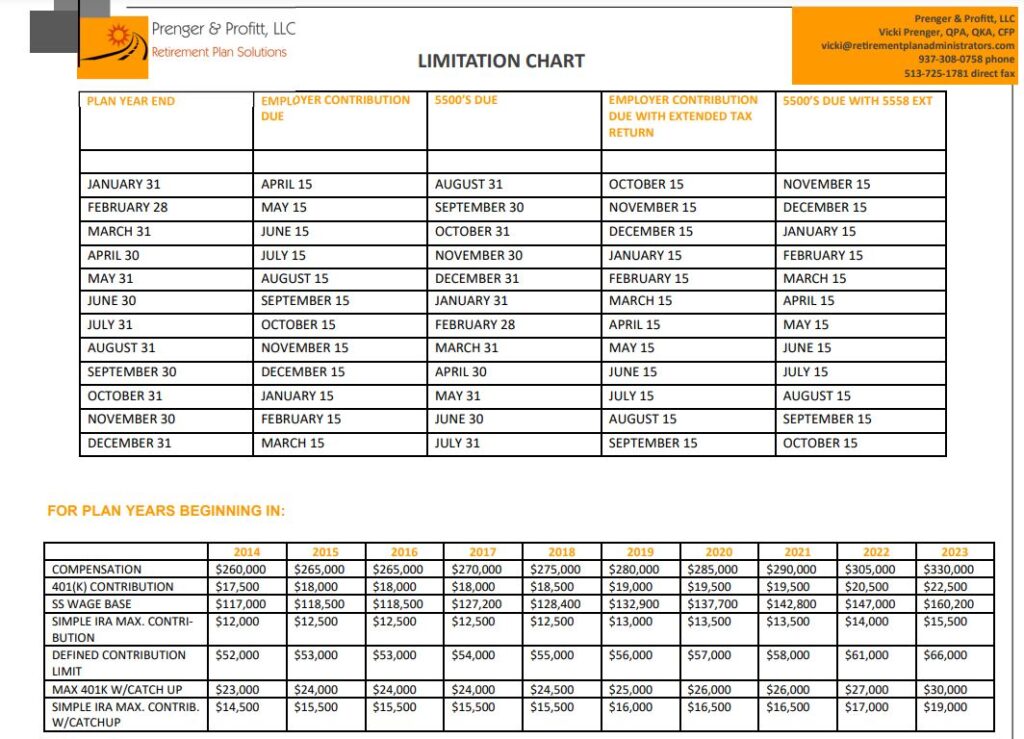

- 401(k) contribution plan limits increased to $22,500 from $20,500 and for those over age 50, the catchup contribution is now $7,500 – up from $6,500. That means if you are over age 50, you can put $30,000 in your 401(k) in 2023!

- For those with 403(b) and 457(b) accounts, the increases are the same — from $20,500 to $22,500 and the catchup for those older than 50 is now $7,500 as well.

- Self-employed? Those with SEP-IRAs or the solo/individual 401(k) now have contribution limits of $66,000 – up from $61,000.

- Those with SIMPLE IRAs can now contribute $15,500 – up from $14,000 with a catchup option of $3,500 for those over 50.

- And finally, both traditional and Roth IRA contributions will go up by $500.

If you aren’t saving every penny you can – about 80 percent of people aren’t – now is the time to increase your savings!

Do you still have questions about retirement planning options, 2023 contribution limits or how your small business can participate?

Follow us on LinkedIn and Facebook!

If you have other questions about retirement plan loans,email us or call 937.308.0758.

Recent Comments