Each individual has different needs when it comes to their finances. According to statistics, people today are saving more. But that isn’t the question. The real question is if it is enough. It all depends on their lifestyles and their needs. Our daily needs are constantly changing so it’s hard to predict for the future so this only proves that there is no simple answer to planning for your retirement.

money.usnews.com

So how do you know if you’re actually saving enough for retirement? The best way to find out is to be ready for it and do some work to get the answers you’re looking for. Take into consideration your present status and also, what you’re 5-year plan is. Do you want to be a small business owner, a free-lancer, or contractor? With these types of positions, you will have to take your retirement plan into your own hands.

One good way to have enough for retirement is to start saving early. The sooner you start saving, the more time your money can grow. You also have to stick to the plan and do this regularly. Get a finance professional to help you out if you need it.

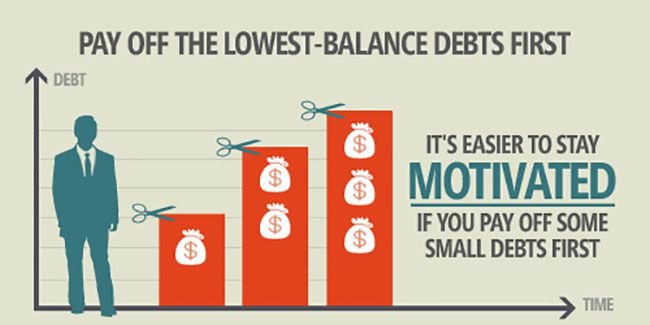

Another tip is to try paying down higher interest debt first, like credit cards. Doing so can free up more money for other investments…like your retirement plan!

yoursmartcredit.com

Speaking of investments, knowing where to put your money is also a good idea. Put your money into tax-advantaged accounts. Purchase a long-term care insurance to lessen your medical expenses when you retire. Invest in a good retirement plan that will work for you. There are endless options for you to put your money towards, so be smart and invest them wisely.

This calculator might be helpful to see if your money will be sufficient enough for your retirement or if you will need additional savings!

We hope that this article helped prepare you a bit more to begin saving for your retirement. Contact us at Prenger & Profitt to get custom retirement solutions crafted just for you!

Recent Comments