Back in May, American’s won protections regarding the purity of their retirement advice last month. Now it’s up to the nation’s financial advisers to change up how they do things after using the historic investor protection regulation since forever!

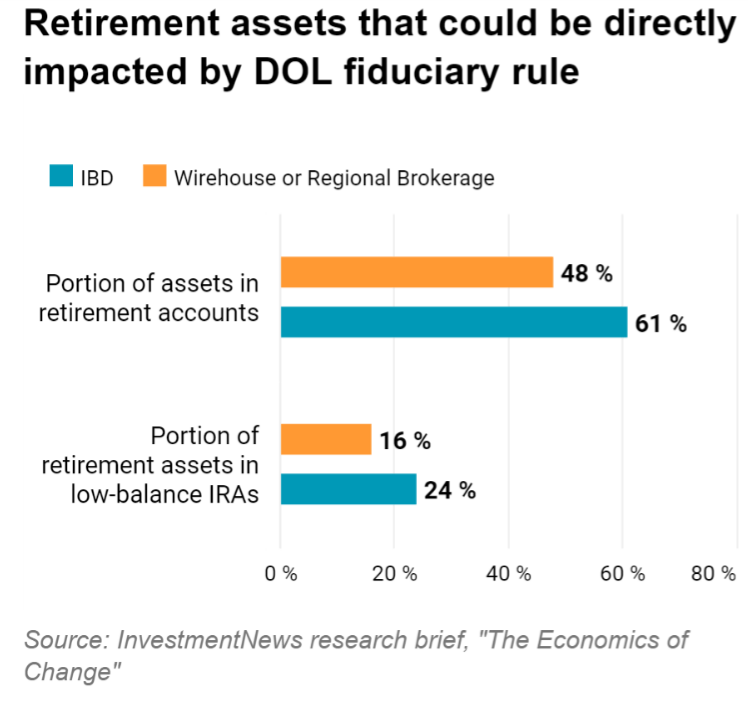

Check out this fun infographic that gives a better visual to the effects we’re going to see happening soon:

www.carsoninstitutional.com

So, what can we take away from this infographic?

- Impacts to advisors include increased regulatory costs and business expenses and potentially lower revenue.

- Impacts to investors include:

- Fewer options for smaller account sizes

- Increased rollover cash-outs

- A potential decrease from already low savings rates in retirement savings for Americans.

This doesn’t really sounds too appealing to either side though, right?! So why was this such a big deal for the Department of Labor, other than the purity of Americans retirement advice?

Well, the new fiduciary rule is, “aimed at stopping the $17 billion a year the government claims investors waste in exorbitant fees. The idea is that the regulation will stop advisers from putting their own interests in earning high commissions and fees over clients’ interests…” (www.investmentnews.com)

Now, THAT makes sense.

So who is this going to affect the most, you ask? Independent broker-dealers.

They’re going to have to craft brand new administrative steps and invest millions (yes, millions) in technology and training to meet the rule’s requirements. Many advisers will face changes in how they are paid.

Advisers will have to look closely at the needs of each client to determine if they can still be met under the existing account structure. If not, they will have to determine whether a change will be in the client’s best interest, come next April!

As a result from this latest DOL fiduciary rule:

- Mutual funds and ETF’s will be more cost-conscious

- Retirement plan sponsors will have higher costs

- Lawyers will probably be getting some new clients (Experts expect client lawsuits to start flying the first time the market tanks after the DOL rule is fully implemented in January 2018, yikes!)

- Client’s will also have raised consciousness when choosing their financial advisor.

Republican lawmakers have already passed congressional resolutions to kill the DOL regulation. But President Barack Obama has pledged to stop those with a veto, and opponents don’t have enough votes in Congress to override that veto.

So I guess we’ll see what happens when our new President is in the ole office! Things may get pretty interesting in the DOL world!

Recent Comments